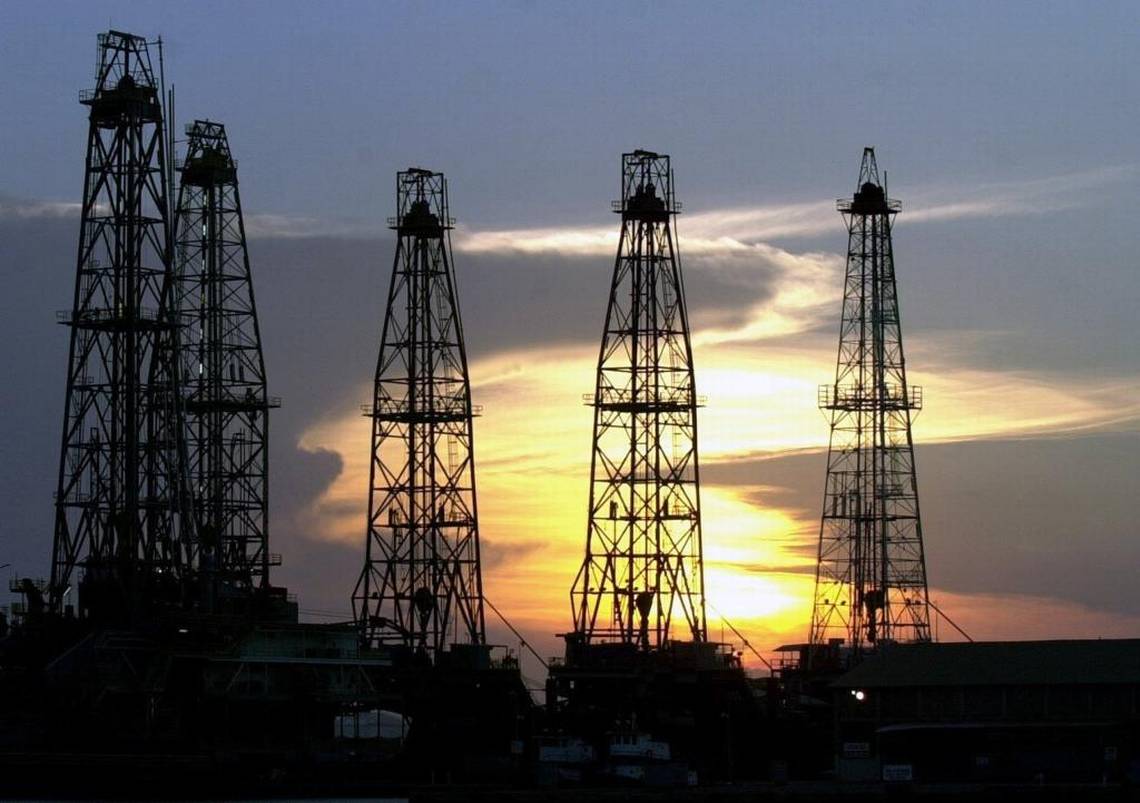

Saudi Arabia may cut oil production

Oil rose by more than 1 percent on Monday, set for its largest one-day increase in a month after Saudi Arabia said OPEC and its partners believed demand was softening enough to warrant an output cut of 1 million barrels per day.

Saudi Arabia, the world’s largest oil exporter, said on Sunday it would cut its shipments by half a million barrels per day in December due to seasonal lower demand.

Saudi Energy Minister Khalid al-Falih said on Monday OPEC and its partners agree that technical analysis shows a need to cut oil supply next year by around 1 million bpd from October levels to avoid an unwelcome build-up of unused crude.

The Organization of the Petroleum Exporting Countries and the International Energy Agency release their respective monthly reports on the outlook for oil supply and demand later this week.

The oil price has fallen by around 20 percent in the last month, driven lower by a rapid increase in global supply and the threat of a slowdown in demand, especially from those customers, such as India, Indonesia and China, whose currencies have weakened against the dollar and eroded their purchasing power.

Production from Saudi Arabia, Russia and the United States alone has risen by 1.05 million bpd in the last three months, based on official output figures.

This has left OPEC scrambling to adjust its own output, which, at around 33.3 million bpd, accounts for roughly a third of total global daily supply.

“One thing that is abundantly clear, OPEC is in for a shale shocker as U.S. crude production increased to a record 11.6 million barrels per day and will cross the 12 million threshold next year,” said Stephen Innes, head of trading for Asia-Pacific at futures brokerage Oanda in Singapore.

Saudi Arabia, the de facto leader of OPEC and Russia, which heads an alliance of producers outside the cartel, agreed to boost production at a meeting in June over fears U.S. sanctions on Iran would trigger shortages.

Three days after the sanctions went into effect on Nov. 5, U.S. oil entered a bear market.