Expert opinion

Technical analysis : Gold falls below 1,225

No matter how strong the technical perspective of a Gold surge can be, changes in the fundamental situation of the US Dollar are capable of destroying any kind of forecast, by changing the whole base of the markets. Due to a decision made by the President of US Donald Trump, the yellow metal fell on Thursday and continued to do so on Friday. If the situation persists, the bullion will fall at least to the 1,219.20 mark, where the 38.20% Fibonacci retracement level is located at. On the other hand, the yellow metal might rally and surge back up to the weekly R1 at 1,233.81.

Sell high now (by W. Snyder)

The last Newsletter predicted the arrival of the Renminbi in grand style and the penultimate number underlined the bond rout and the fact that the US Dollar is overvalued. The huge American national debt has been repeatedly mentioned as well as the enormous US trade deficit.

Loans For Small Businesses

How and where can a small business get a loan that is not from the bank?

US Dollar vs Renminbi (by W. Snyder)

The US dollar may appreciate further and become even more overvalued before the turning point is reached. The Trump effect may last a bit longer, but by Q4 2017 and no later than the end of H1 2018 the tide will begin to turn against the greenback

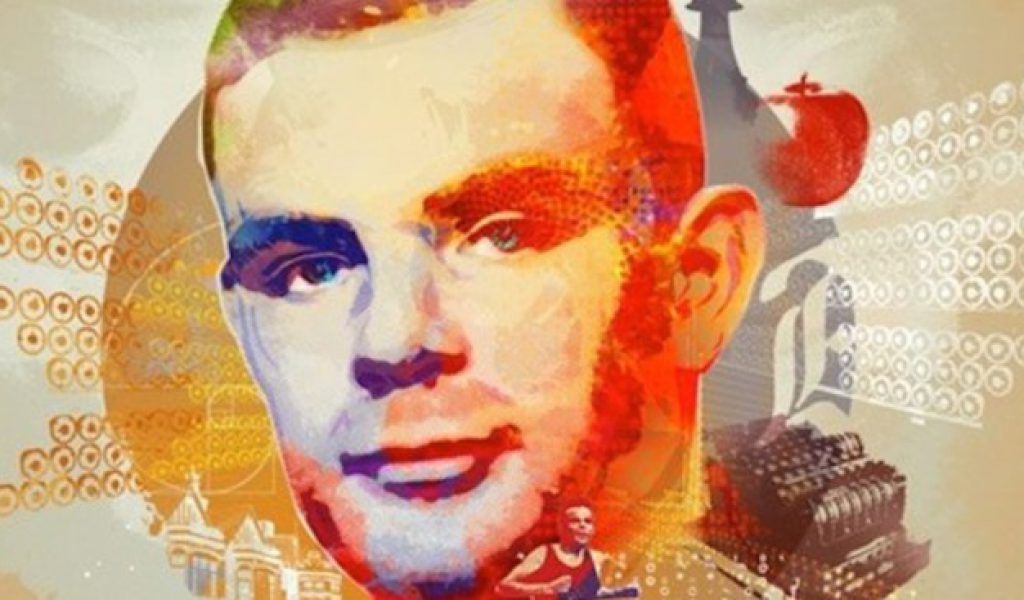

Turing and the price graphs

Alan Turing was a mathematician who lived in the twentieth century and which is considered the father of theoretical computer science and artificial intelligence. In 1950 he wrote an article in Mind (1) in which he formulated the basics of his test, a criterion for deciding whether a machine is able to think or not. A computer can mimic human thought and deceive a person?