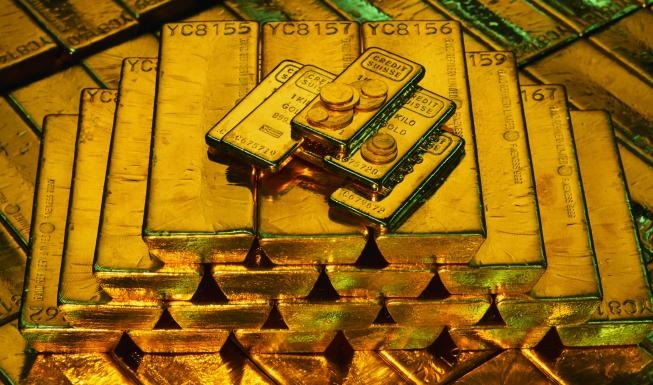

Gold plunges on Monday for a Fat Finger

The price of gold fell to a multiweek low on Monday after a trader made a grave mistake. Spot gold fell around 1% Monday morning to trade as low as $1,236.46, which marks the lowest level the commodity has seen since May 17, Bloomberg reported. U.S. gold futures also lost nearly 1 percent to trade at $1,245.40 an ounce.

The decline in gold is attributed to a large market order of 18,500 lots of gold, which represents 1.85 million ounces. This was likely a mistake, or a "fat finger" trade, as the order is bigger than anything seen at the peak of domestic political turmoil and the surprising outcome from the Brexit vote.

The trader or institution who placed likely "pressed the wrong button," David Govett, head of precious metals trading at Marex Spectron Group, told Bloomberg. Or perhaps the sell order was made as intended under the assumption that the market could absorb the large order.

But as the day went on — and the price of the wedding band material failed to correct itself — Wall Street analysts questioned whether the order was too big, or just too fast.

“When you look at what happened with the flash crash — the flash crash corrected itself pretty instantaneously,” said Todd Colvin, senior vice president and trading firm Ambrosino Brothers, referring to the May 2010 stock-market whiplash when the Dow Jones industrial average fell about 1,000 points before recovering minutes later.

“This bears the hallmarks of a fat-finger ‘Muppet’ — a trade of 18,149 ounces would be a very typical trade, but a trade of 18,149 lots of a futures contract (which is 100 times bigger) would not be,” Ross Norman, chief executive officer of Sharps Pixley Ltd., a London-based precious-metals dealer, said in a note. “It leaves us wondering if a junior had got confused between ‘ounces’ and ‘lots,’ Norman said.

Gold has had a rocky year so far, declining from the yearly high of $1,294.17 it reached on June 6. Rising interest rates, a strong dollar, and a skyrocketing stock market have all damped enthusiasm for the shiny metal.

Either way a mistake was made, and the price of gold hasn't fully recovered, which shows that flash crashes can occur in any tradeable market — not just stocks. Last year, the British pound suffered a flash crash and plummeted 6 percent in one minute on no news.